80,000 purchases in underserved neighborhoods not yet Opportunity Zones since 2018

36 percent of those purchases are in rural areas, with the rural share growing

More than 70 percent resold to owner-occupants, requiring 27 percent of income to buy

President Trump’s Big Beautiful Bill signed into law July 4, 2025, calls for an expansion of Opportunity Zones, with a particular emphasis on rural areas. Local community developers buying and renovating distressed properties on Auction.com are already blazing a trail for such an expansion.

“By targeting distressed properties in Birmingham’s underserved neighborhoods, we’re not just improving housing stock, we are driving measurable economic impact,” said Lindsay Davis, an Auction.com buyer and CEO of Spartan Invest, a company that buys and renovates distressed homes in Birmingham, Alabama.

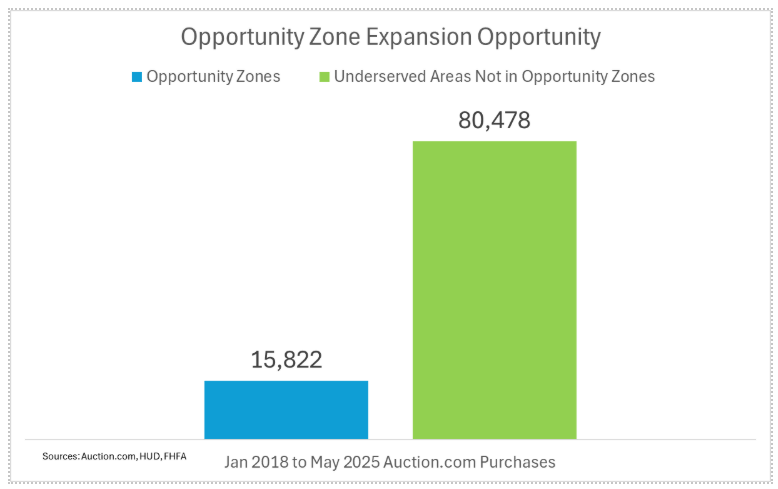

Auction.com buyers have purchased more than 15,000 properties in Opportunity Zones since 2018, when the original Opportunity Zone program first launched. Nearly half of those properties (46 percent) are in rural areas as defined by the Census Bureau. That’s according to an analysis of proprietary Auction.com sales data matched against Opportunity Zone data from the U.S. Department of Housing and Urban Development (HUD).

Beyond Opportunity Zones

The local community developers like Spartan Invest who comprise the majority of Auction.com buyers have gone beyond current Opportunity Zones to buy distressed properties in many other neighborhoods that are prime candidates for the proposed Opportunity Zone expansion.

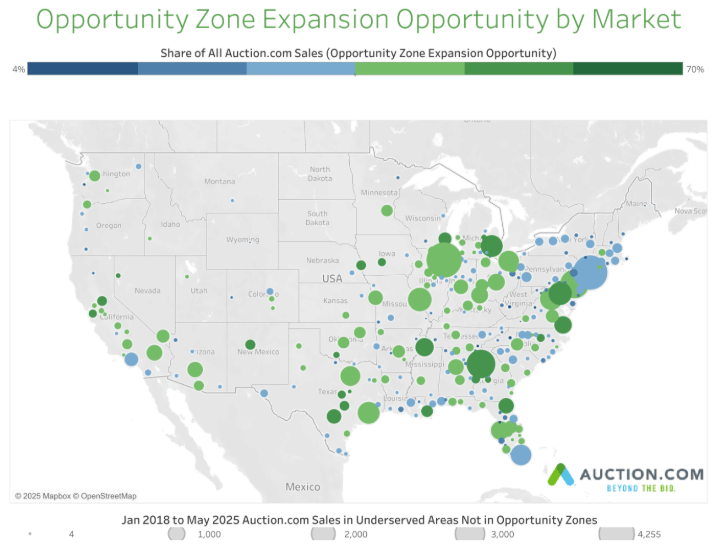

Since 2018, more than 80,000 properties have been purchased via Auction.com in neighborhoods defined as underserved by the Federal Housing and Finance Agency (FHFA). Those 80,000 purchases represent about 40 percent of all Auction.com sales over that period and exclude properties in underserved neighborhoods that are already designated as Opportunity Zones.

FHFA designates a Census tract as underserved if its median income does not exceed 80 percent of the surrounding area’s median income (AMI) or if it has a minority population of at least 30 percent and its median income is less than 100 percent of the AMI.

More than half (57 percent) of the 54 properties purchased by Spartan Invest on Auction.com since 2018 are in underserved Census tracts as defined by the FHFA. But only one of Spartan’s purchases is in a Census tract already designated as an Opportunity Zone.

“Renovated homes lead to increased property values, expanded tax bases, and higher rates of occupancy,” said Davis. “Each renovation project supports dozens of local jobs, from contractors to suppliers, along with encouraging further private investment in areas that have long been overlooked. This kind of grassroots development proves that Opportunity Zones expansion can be a powerful tool for neighborhood revitalization.”

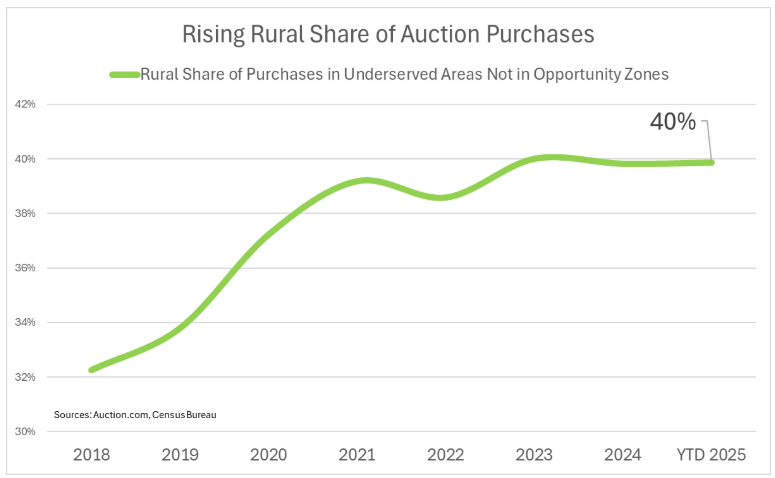

Rising Rural Share

Of the 80,000 properties purchased by Auction.com buyers in underserved areas over the last seven years, more than 29,000 (36 percent) are in rural areas. And that rural share has been steadily increasing, from 32 percent in 2018 to 40 percent in 2023 and 2024 — as well as so far in 2025.

Spartan Invest exceeds the national trend, with 45 percent of its Auction.com purchases in underserved neighborhoods in areas defined as rural by the Census Bureau.

The rural share is important because it aligns with the proposed legislation, which would require that at least one-third of new Opportunity Zones in each state be in rural areas.

High Homeownership Rates

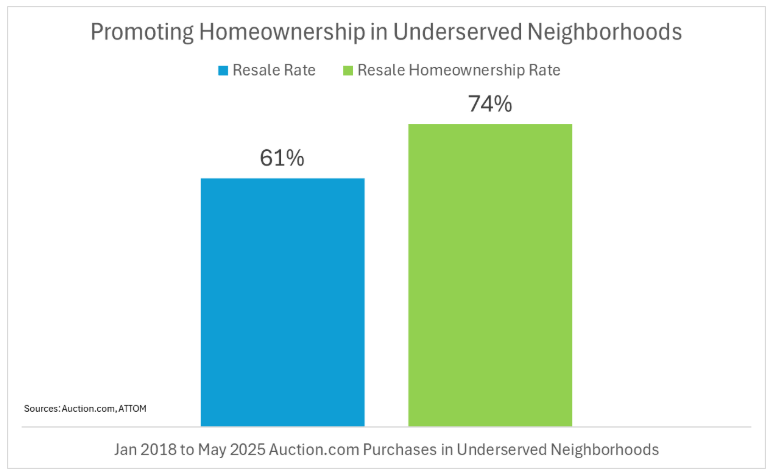

The local community developers buying distressed properties at auction in underserved neighborhoods are helping to revitalize those neighborhoods by providing quality affordable housing while also helping to boost homeownership rates and job creation.

More than half (54 percent) of the more than 15,000 Opportunity Zone purchases on Auction.com have subsequently been resold, and 71 percent of those resales are now owner-occupied, according to an analysis of public record data.

A similar trend shows up in underserved areas not yet designated as Opportunity Zones, with 60 percent of those Auction.com sales subsequently resold, and 74 percent of those resales now owner-occupied.

Resurrecting Home Values

Local community developers like Spartan Invest are typically performing high-quality renovations to improve the value of the distressed properties they purchase — and by extension the surrounding neighborhood.

Among resales of Auction.com Opportunity Zone purchases that occurred within one year, the average price-to-after-repair value ratio increased by an average of 42 percentage points between the auction sale and the resale. The 42-point increase in value occurred over an average of 194 days.

A similar value-add trend shows up in underserved areas not yet designated as Opportunity Zones, with an average 40-point increase in property value over an average of 187 days.

“You’re resurrecting things a lot of times. Assets that are just dead,” said Charles McBride, an Auction.com buyer in Wichita, Kansas, who heads up online acquisitions for a company that buys and renovates distressed properties throughout the Wichita metro area.

“The housing stock is just beat up,” McBride added, referring to the Wichita market. “We have an incredibly active, entrepreneurial spirit … so a lot of this inventory has been worked over with flips. … The quality of the housing, I think it’s improving.”

Affordable Housing Supply

Despite the renovation-fueled increase in value, resales of distressed properties in Opportunity Zones and other underserved neighborhoods are still affordable for local families.

Resales of Auction.com-purchased properties in Opportunity Zones sold for an average price of $197,915, requiring an average of 27.2 percent of the median family income in the surrounding Census tract to buy — including mortgage payment, property taxes and insurance, according to an Auction.com analysis using public record data. Properties held as rentals have an estimated fair market rent of $1,381, representing 29.5 percent of the median family income in the surrounding Census tract on average.

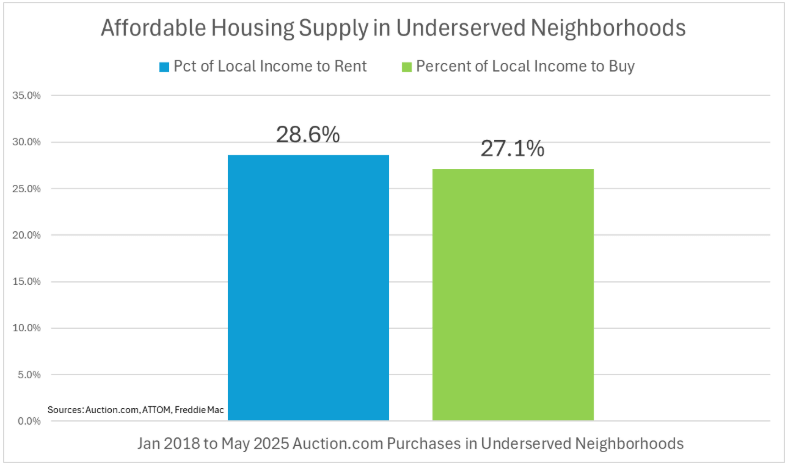

In underserved neighborhoods not yet designated as Opportunity Zones, the average resale price was $223,782, requiring 27.1 percent of the median family income in the surrounding Census tract to buy and 28.6 percent of the median family income to rent.

Growing Opportunity

Meanwhile foreclosure auction volume is steadily growing, including in underserved rural markets that are not yet in Opportunity Zones. Expanding Opportunity Zones to many of these areas will help convert more distressed properties into quality affordable housing and revitalize those neighborhoods with higher homeownership rates and more jobs.

Foreclosure auction volume nationwide is up 27 percent in the first five months of 2025 compared to the same period in 2024, but the increase is even higher in underserved Census tracts that are not yet designated as Opportunity Zones (up 33 percent) and still higher in the subset of those underserved neighborhoods in rural areas (up 37 percent). That’s according to proprietary data from Auction.com, which accounts for about half of all foreclosure auction volume nationwide.

Through May 2025, states with the most foreclosure auction volume in rural underserved neighborhoods not yet designated as Opportunity Zones were Texas, Louisiana, Alabama, California and Georgia.

Among states with sufficient volume so far in 2025, those with the biggest year-over-year increases in foreclosure auctions in rural underserved tracts not yet designated as Opportunity Zones were West Virginia (257%), Kansas (200%), Arizona (165%), Minnesota (110%) and Alabama (100%). Other notable states were Washington (up 93%), Texas (up 84%), Colorado (up 79%), Michigan (up 69%) and New York (up 69%).

Metro areas with the most foreclosure auction volume so far in 2025 in rural underserved neighborhoods not yet designated as Opportunity Zones were Houston, Atlanta, Dallas, Birmingham, San Antonio, Phoenix and St. Louis.