Foreclosure Auction Volume Increases 48 Percent to a Nearly Six-Year High in Q4 2025, Still 39 Percent Below Pre-Pandemic Level

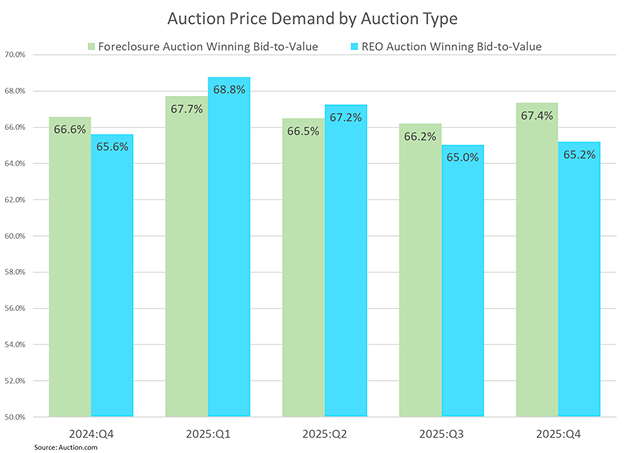

Diverging pricing trends between foreclosure auctions and REO auctions contribute to contrasting demand trends for the two distressed property sales venues.

January 29, 2026

KEY POINTS

- Foreclosure auction volume increased from a year ago in 42 states and for all loan types

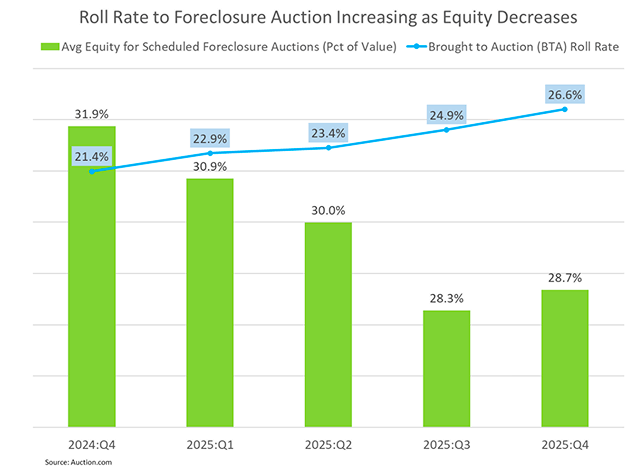

- Roll rate to foreclosure auction increased to a more than three-year high as distressed property equity continued to erode

- Bank-owned (REO) auction volume increased 21 percent to a more than five-year high, still 54 percent below pre-pandemic level

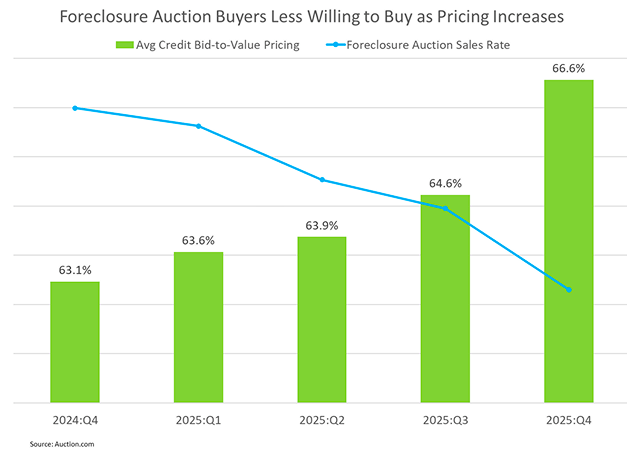

- A 22-quarter high in pricing at foreclosure auction corresponds to a 23-quarter low in buyer demand

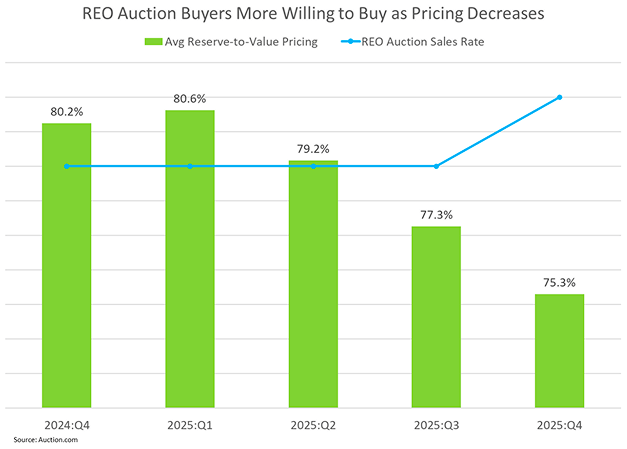

- A 21-quarter low in pricing at REO auction corresponds to a nearly two-year high in buyer demand

- Foreclosure auction buyers willing to pay more than a year ago in half of major markets, including New York, Atlanta and San Antonio

OVERVIEW

Q4 2025 showed foreclosure auction supply increasing year-over-year, including a more than three-year high in conversion of scheduled foreclosure properties into completed auctions. Auction buyer activity weakened, led by a lower sales rate and fewer saves per property brought to auction. Pricing signals were mixed: buyers paid slightly more relative to estimated value at foreclosure auction, but seller asking prices rose faster, contributing to a wider foreclosure bid-ask spread. In contrast, seller pricing at REO auction declined, contributing to a narrower REO bid-ask spread and a higher REO auction sales rate.

The sharp divergence between foreclosure auction pricing and REO auction pricing in the fourth quarter of 2025 provides a good natural experiment illustrating the impact of pricing on buyer demand (see more in the Distressed Pricing section below).

A survey of Auction.com buyers in early January 2026 shows a slight increase in willingness to buy compared to the previous quarter: 23 percent of those surveyed said market conditions were making them more willing to buy at auction, up from 19 percent in the previous quarter. That 23 percent was slightly below the 24 percent who said market conditions were making them more willing to buy in the first quarter of 2025.

“If rates continue lower I’ll buy more,” wrote survey respondent Michael, an Auction.com buyer in Texas.

DISTRESSED DEMAND

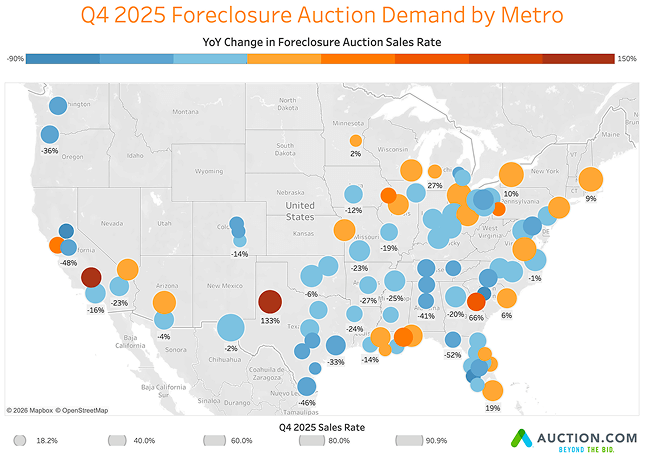

Foreclosure auction buyer activity slowed in Q4 2025. The foreclosure auction sales rate — a good measurement of buyers’ willingness to buy at the price provided — declined 7 percent quarter-over-quarter and 15 percent year-over-year to a 23-quarter low. The sales rate declined steadily throughout the quarter, ending at a 68-month low in December.

The sales rate decreased from a year ago in 69 percent of 88 major markets analyzed, including Chicago (down 16 percent), Dallas-Fort Worth (down 27 percent), Houston (down 33 percent), Atlanta (down 20 percent) and St. Louis (down 19 percent).

“Waiting to see how current events and policies of the U.S. government are going to shape this year,” wrote survey respondent David, an Auction.com buyer in California, where the sales rate decreased in five of six metros analyzed.

Markets with annual increases included New York (up 2 percent), Phoenix (up 18 percent), Minneapolis-St. Paul (up 2 percent), Miami (up 19 percent) and Pittsburgh (up 40 percent).

The highest sales rates (buyers most willing to buy at the price provided) were in El Paso, Texas; Buffalo, New York; Toledo, Ohio; Boston, Massachusetts; and Richmond, Virginia. The lowest sales rates (least willing to buy) were in Minneapolis-St. Paul; Corpus Christi, Texas; Houma-Thibodaux, Louisiana; Flint, Michigan; and Pueblo, Colorado.

REO bidder engagement also weakened: REO bidders per asset dropped 14 percent quarter-over-quarter and was down 17 percent year-over-year to a 31-quarter low (lowest since Q1 2018). But counter to the declining foreclosure sales rate trend, the REO auction sales rate increased 29 percent from both the previous quarter and a year ago to the highest level since Q1 2024. This could be in part due to more favorable pricing at REO auction (see pricing section).

“My pool of workers are influencing how quickly I can put a property on the market. It’s getting harder and harder to find good help,” wrote survey respondent Elaine, an Auction.com buyer in Missouri.

Price Demand

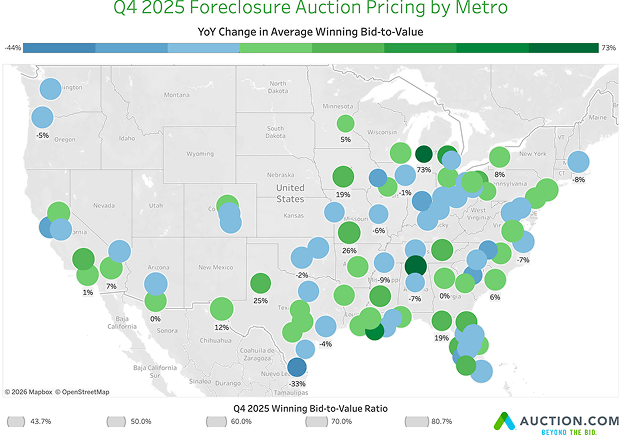

There were early data indicating buyers were willing to pay more at auction, at least in some markets. This could be a sign of recovering confidence in the housing market. Foreclosure auction buyers paid an average of 67.4 percent of estimated value in Q4 2025, up from 66.2 percent in the previous quarter and 66.6 percent a year ago. Foreclosure price demand decreased throughout the quarter after hitting a 19-month high in October.

REO auction buyers paid an average of 65.2 percent of estimated value in Q4 2025, up from 65.0 percent in the previous quarter but down from 65.6 percent a year ago.

A new automated valuation model (AVM) was used to calculate price-to-value in this report. This new AVM was applied retroactively to calculate price-to-value ratios in previous quarters, but these ratios may not line up with numbers published in previous quarterly reports. The new AVM is calibrated to identify the value of the house in average condition while the previous AVM was calibrated to identify the value of the home in fully repaired condition.

Foreclosure price demand decreased from a year ago in exactly half of the 88 major markets analyzed (44), including Chicago, Dallas, Houston, St. Louis and Phoenix. Foreclosure price demand increased from a year ago in the other 44 markets, including New York, Atlanta, San Antonio, Philadelphia and Minneapolis-St. Paul.

Markets with the strongest foreclosure price demand were El Paso, Texas; Phoenix; Sacramento; New York; and Miami. Markets with the weakest price demand were Grand Rapids, Michigan; Minneapolis-St. Paul; the Quad Cities in Iowa; Pittsburgh; and Gulfport, Mississippi.

DISTRESSED SUPPLY

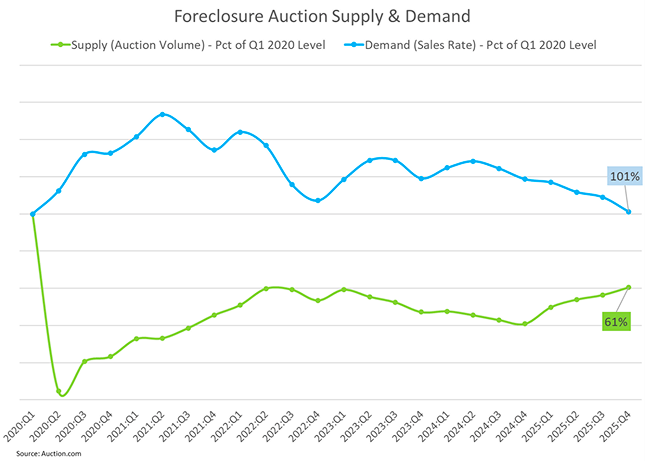

Scheduled foreclosure auctions were unchanged quarter-over-quarter but up 19 percent year-over-year and at 62 percent of the Q1 2020 level (the same share as last quarter).

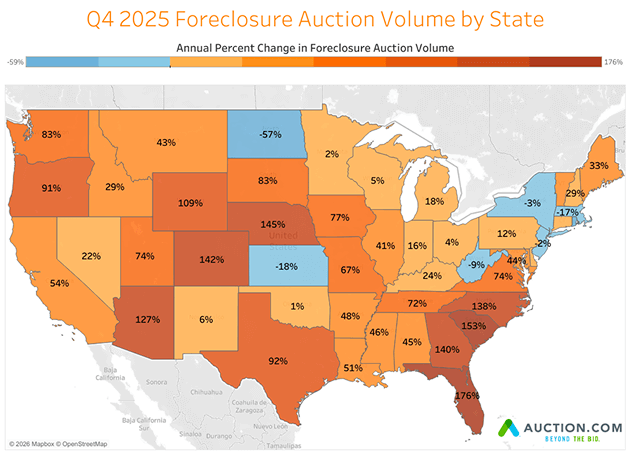

Foreclosure properties brought to auction (BTA) were up 7 percent quarter-over-quarter and up 48 percent year-over-year to a 23-quarter high, reaching 61 percent of the Q1 2020 level. Q4 2025 marked the fourth consecutive quarter with an annual increase in foreclosure BTA, and the 48 percent increase was the biggest since Q3 2022.

Foreclosure BTA volume hit a 69-month high (highest since March 2020) in October, then decreased seasonally in November and December, although November’s and December’s numbers were still up year-over-year.

Foreclosure BTA volume in Q4 2025 increased from a year ago in 43 states, including Texas (up 92 percent), Florida (up 176 percent), Ohio (up 4 percent), Illinois (up 41 percent) and Georgia (up 140 percent).

“Expecting more inventory in the second quarter of 2026. This is impacting how I am currently investing as more inventory will most likely lower overall prices,” wrote survey respondent Patrick, an Auction.com buyer in Ohio.

Despite the widespread annual increases in Q4 2025, only 13 states posted foreclosure auction volume that was above the pre-pandemic level of Q1 2020. Those states include Texas, Louisiana, Colorado, Minnesota and Oklahoma.

Foreclosure BTA volume was up year-over-year for all loan types, led by VA-insured loans (up 428 percent). A 2024 foreclosure moratorium on most VA-insured loans contributed to the large increase in that category. Other annual increases included FHA-insured (up 56 percent), GSE (up 33 percent), privately held (up 12 percent) and USDA-insured loans (up 10 percent).

The roll rate from scheduled foreclosure auction to foreclosure BTA (BTA rate) was up 7 percent quarter-over-quarter and up 24 percent year-over-year to a 14-quarter high of 26.6 percent, but still below the 2019 average level of 30.7 percent. This shows more properties scheduled for auction are actually making it to auction. The BTA rate was relatively level at around 26 percent to 27 percent for all three months in the quarter.

The average loan-to-value (LTV) ratio for properties scheduled for foreclosure auction was down 1 percent from a nine-quarter high in the previous quarter but still up 5 percent year-over-year. A higher LTV means less equity in properties scheduled for auction, and less equity is likely helping to boost the BTA rate.

REO BTA volume was up 8 percent quarter-over-quarter and up 21 percent year-over-year to a 22-quarter high (highest since Q2 2020) and at 46 percent of the Q1 2020 level.

Vacant REO BTA increased 24 percent year-over-year to a 22-quarter high (highest since Q2 2020). Vacant properties accounted for 54 percent of all REO BTA, matching the previous two quarters for the highest level since Q4 2021.

“I do prefer more of the vacant properties. They are more appealing as there is a quicker turnaround for selling without another party involved,” wrote survey respondent Natalie.

DISTRESSED PRICING

Pricing increased at foreclosure auction but decreased at REO auction. Those divergent trends contributed to contrasting trends in the bid-ask spread and the sales rate, illustrating the impact of auction pricing on buyer demand.

Foreclosure auction pricing: The average credit bid-to-value increased by 200 basis points from the previous quarter and was up 351 basis points from a year ago. Although buyers were willing to pay slightly more at foreclosure auction in Q4 2025, the jump in seller asking prices was much sharper, contributing to a wider foreclosure bid-ask spread of 772 basis points, up from 735 basis points in the previous quarter but down from 839 basis points a year ago.

The 200-point rise in foreclosure auction pricing also corresponded to a 330-point decrease in sales rate at foreclosure auction.

“Just mostly on pause ’til rates and prices come back down,” said survey respondent William, an Auction.com buyer in Ohio.

REO auction pricing: The average credit bid-to-value at REO auction decreased by 197 basis points from the previous quarter and was down 495 basis points from a year ago to the lowest pricing since Q3 2020. This helped narrow the bid-ask spread at REO auction to 1,009 basis points in Q4 2025, down from 1,222 basis points in the previous quarter and down from 1,461 basis points a year ago.

The nearly 200-point quarterly drop in REO auction pricing also corresponded to a 400-point rise in sales rate at REO auction.

MACROECONOMIC TRENDS

Rate

Probability

Index

Sentiment Index

HOUSING & MORTGAGE TRENDS

Home Sales

Prices

Mortgage Rate

Mortgage Rate