Foreclosure Auction Volume Climbs 19 Percent to 2-Year High in Q2 2025 as Demand from Auction Buyers Drops to Multi-Year Lows

Rising trends in scheduled auctions and auction completion rate point to more volume coming

July 22, 2025

KEY POINTS

- REO auction volume up 20 percent from a year ago to a more than 2-year high, with vacant REOs leading the way

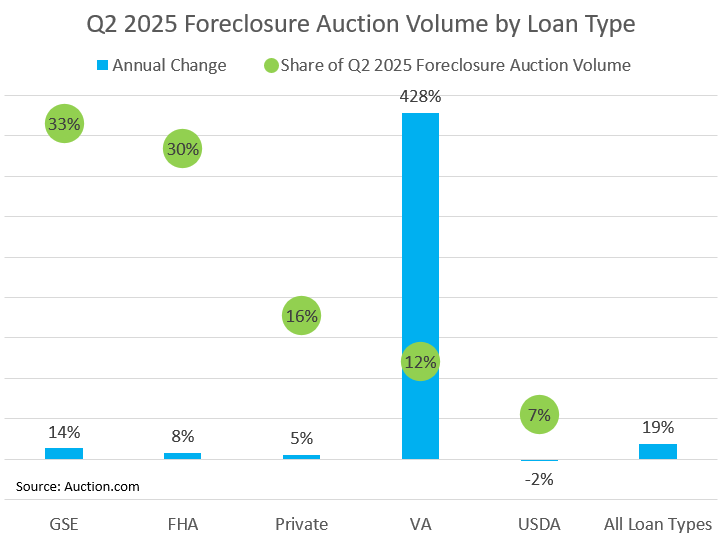

- VA-insured loans lead foreclosure auction increase, jumping 428 percent annually after moratorium expiration

- Foreclosure auction demand falls to a 30-month low while REO auction demand drops to an almost six-year trough

- Price demand from buyers drops 3 percentage points for foreclosure auctions and 6 points for REO auctions compared to a year ago

- Bid-ask spread widens for both foreclosure and REO auctions despite slightly lower pricing from sellers

OVERVIEW

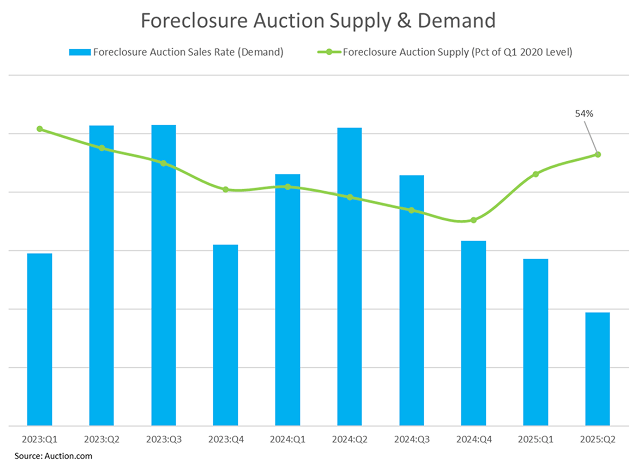

The supply of distressed properties available at auction continued to climb in the second quarter of 2025, reaching two-year highs even while demand from auction buyers dropped to multi-year lows, signaling a shift in the distressed marketplace that could have implications for the broader real estate market.

“The interest rates have killed the market,” wrote a Texas-based Auction.com buyer in response to a buyer survey conducted in the second week of July. “My hold time from two years ago was averaging 120 days. Now I have properties that are sitting with over two years on market.

“Existing homes have crashed,” the Texas-based buyer continued. “Homeowners are starting to drop prices to sell homes to ward off foreclosure, which is creating a lower appraised value nightmare for investors.”

Although still well below pre-pandemic levels, the gradual rise in distressed volume over the past two quarters will likely put more downward pressure on home price appreciation, already increasingly burdened by the rising inventory of homes for sale in the retail market. Auction buyers as a group are a good barometer of future retail market trends, and the clear pullback in demand from that group over the past year indicates future weakness in the retail housing market.

In the July survey, 38 percent of Auction.com buyers surveyed said that market conditions are making them less willing to buy, unchanged from the previous quarter but up from 34 percent in the third quarter of 2024.

Buyer expectations for future months were more positive, with 37 percent of those surveyed saying they plan to buy more auction properties in the next three months compared to the previous three months. That was up from 33 percent in the previous quarter’s survey.

“I am holding liquid assets due (to) unfavorable and volatile market conditions. Waiting for (the) right entry,” wrote a Northern California-based survey respondent who said market conditions have made him less willing to buy but that he is planning to buy more in the next three months.

Supply growth spanned most loan types on the foreclosure auction front, but Veterans Administration (VA) loans were at the extreme forefront, with a 428 percent annual jump following the sunset of a VA foreclosure moratorium in December 2024.

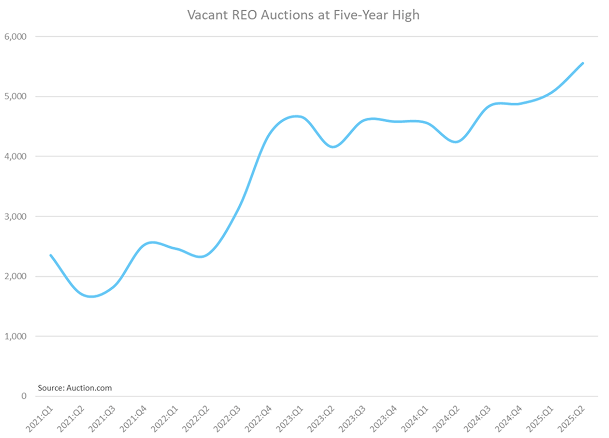

Rising volume at foreclosure auction naturally rippled out to REO auctions, accelerated by a dipping third-party sales rate at foreclosure auction. The REO auction volume was led by vacant properties, which increased 31 percent from a year ago to a five-year high.

“The rise in vacant properties available to buy at auction is good news for the housing market because it means sellers are clearing out more aged inventory of unused, distressed housing stock that can now be transformed into much-needed housing supply by auction buyers,” said Ali Haralson, president at Auction.com. “It’s also good news for less experienced auction buyers, including even owner-occupant buyers, because these vacant properties are typically more accessible, allowing for interior access and not requiring the new buyer to deal with any current occupants.”

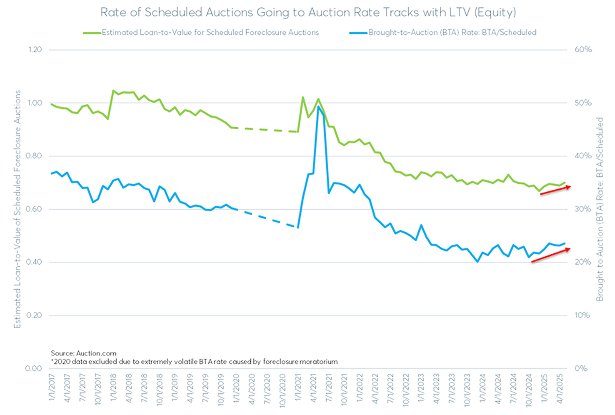

Scheduled foreclosure auction data for future months, along with a rising foreclosure auction completion rate, points to a continued rise in completed auction volume in future months even as demand from auction buyers is dropping in most markets across the country — particularly in the Southeast and Sunbelt.

DISTRESSED DEMAND

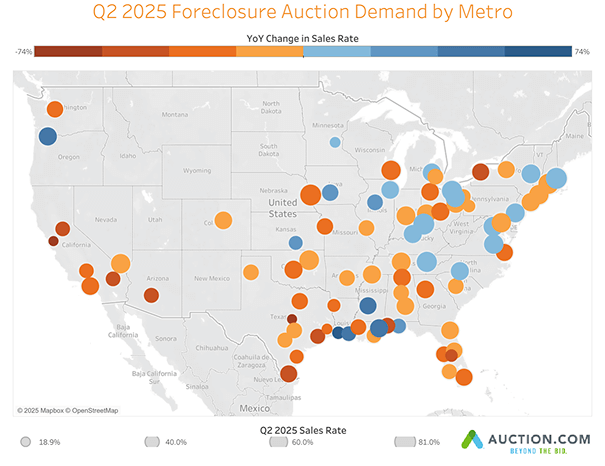

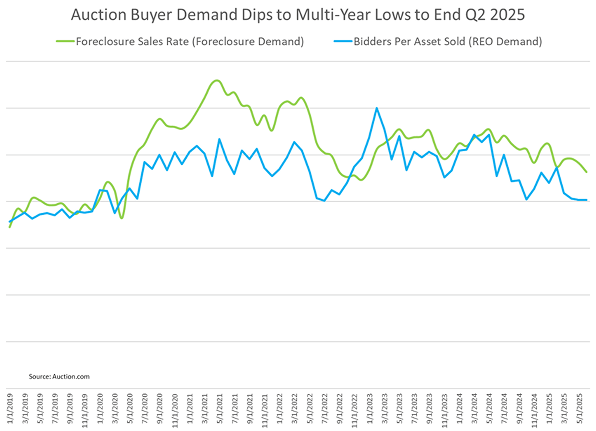

Buyer appetite softened. The foreclosure auction sales rate fell 4 percent quarter-over-quarter and 12 percent year-over-year, ending the quarter at a 30-month low in June.

REO auction demand mirrored the pullback at foreclosure auction. Bidders per asset decreased 9 percent from Q1 and 21 percent year-over-year to the lowest level since 2019. A modest uptick in June hints at a tentative floor, but overall engagement remains muted.

The foreclosure auction sales rate decreased in 71 percent of major markets, including New York, Houston, Dallas, Detroit and Atlanta. Only 29 percent of major metros posted annual gains, including Chicago, Philadelphia, Minneapolis, Washington, D.C., and Cleveland. Boston, Cincinnati, and Omaha ranked among the highest-demand markets, while San Francisco and several Texas metros were among the weakest.

In the July survey, 33 percent of respondents said they are bidding on fewer properties due to market activity over the past 90 days, up from 30 percent in the previous quarter.

“Market unstable due to interest rates, overpriced properties,” wrote a Florida-based survey respondent. “Hate to invest on purchasing or renovating as properties are not holding value and sellers are decreasing prices. Will watch interest rate and property values for meantime and invest money in (the) stock market.”

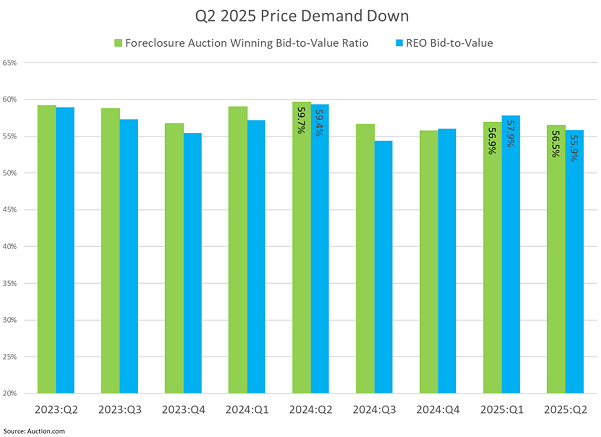

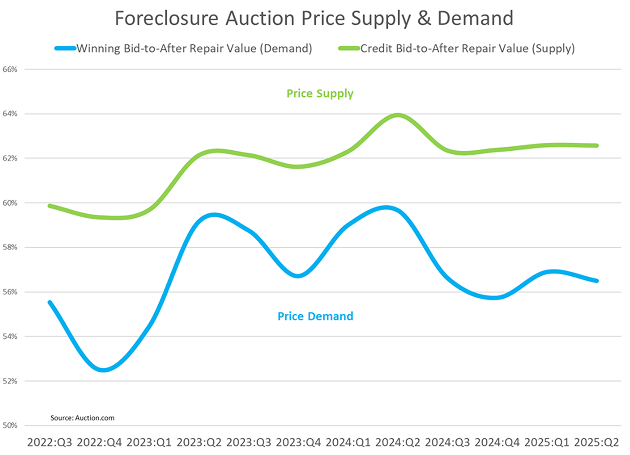

Price Demand

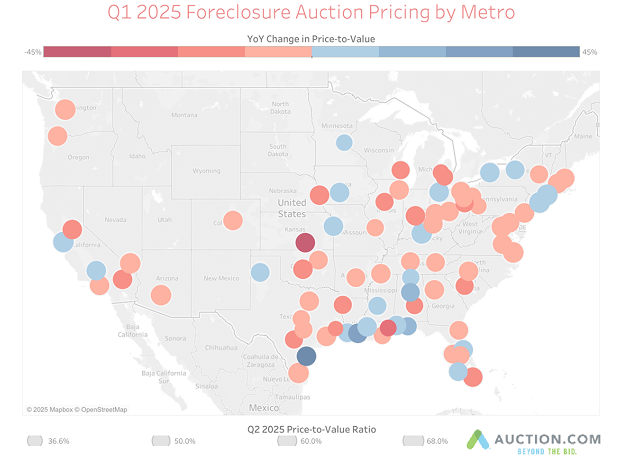

Auction buyers continued to reset price ceilings. Winning bidders at foreclosure auctions paid 56.5 percent of estimated after-repair value on average, down from 56.9 percent in Q1 and 59.7 percent a year earlier. The ratio peaked for the quarter in May before dipping to an eight-month low in June.

At REO auctions, the average bid-to-value ratio slipped to 55.9 percent, down three percentage points quarter-over-quarter and six points year-over-year.

“Tariffs are keeping interest rates high, keeping material cost high, and contractors are still busy,” wrote a Vermont-based survey respondent. “I’m anticipating these will negatively impact the economy. I’m also anticipating a slowdown in Q3 and … don’t want to have too many irons in the fire … with the slowdown coming. I’m still keeping reserves as I don’t want to pass up a good deal.”

Price demand at foreclosure decreased on a year-over-year basis in 57 of 80 major markets analyzed (71 percent), including Chicago, Houston, Dallas-Fort Worth, Detroit, and Atlanta. Counter to the national trend, price demand increased on a year-over-year basis in 23 of 80 major markets analyzed (29 percent), including New York, Minneapolis-St. Paul, Birmingham, Alabama, Baton Rouge, Louisiana, and Kansas City.

DISTRESSED SUPPLY

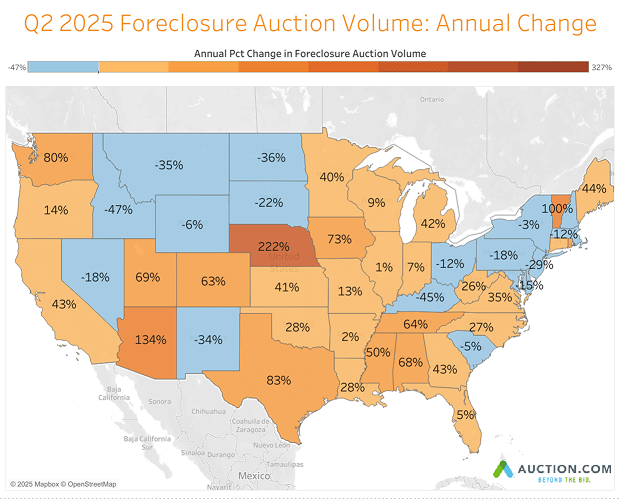

Completed foreclosure auctions rose 8 percent from Q1 and 19 percent from a year ago to 8,500, the highest quarterly total since Q2 2023 and 54 percent of the pre-pandemic Q1 2020 level. Scheduled volume also hit a two-year high at 36,331 — 63 percent of the pre-pandemic benchmark, keeping the future foreclosure auction pipeline well supplied.

“Knowing that there will be a strong foreclosure market soon,” wrote an Arkansas-based survey respondent, explaining what is impacting her real estate investing strategy.

REO properties brought to auction increased 10 percent from the previous quarter and were up 20 percent from a year ago to a more than two-year high (nine quarter high).

REO properties brought to auction were at 43 percent of pre-pandemic levels, the first time above 40 percent since the first quarter of 2023.

Vacant REO auctions increased at an even faster pace, up 31 percent year-over-year in Q1 2025 compared to a 10 percent increase for occupied REO auctions. Vacant REO auctions increased to the highest level since Q2 2020 — a five-year high.

The scheduled-to-completed foreclosure auction conversion rate inched up to 23.4 percent, its highest reading in nine quarters, yet still below the 30.7 percent pre-COVID norm. Higher loan-to-value ratios (0.70 in Q2 vs. 0.68 a year earlier) suggest home equity is eroding, nudging more scheduled cases through to completion.

Eight states now exceed pre-pandemic completed foreclosure auction volume, with Connecticut at 325 percent and Colorado at 170 percent of Q1 2020 levels. Foreclosure auction volume increased from a year ago in 32 states and the District of Columbia. States with annual increases included Texas (up 83 percent), Michigan (up 42 percent), California (up 43 percent), Louisiana (up 28 percent) and Georgia (up 42 percent).

Foreclosure auction volume in Q2 2025 matched or exceeded pre-pandemic levels in 18 of 80 major markets analyzed for the report (23 percent), including Houston, Minneapolis-St. Paul, New Orleans, Indianapolis and Denver. Foreclosure auction volume increased from a year ago in 57 of those 80 major markets (71 percent), including Houston (up 140 percent), Dallas (up 100 percent), Detroit (up 46 percent), Atlanta (up 58 percent), and Phoenix (up 215 percent).

DISTRESSED PRICING

Despite sellers lowering pricing in Q1, the bid-ask spread between what buyers were willing to pay and what sellers were willing to take widened in the quarter for both foreclosure auctions and REO auctions. That’s because price demand dropped faster than price supply.

Seller credit-bid pricing at foreclosure auctions fell a modest 2 basis points quarter-over-quarter, but buyer price demand dropped 40 bps, widening the gap. A similar dynamic played out for REO, where sellers trimmed their reserve pricing by 129 basis points while buyers lowered their offers by 343 basis points.

“Prices are dropping and sellers are not responding,” wrote a Southern California-based buyer who said that market conditions are making him more willing to buy at auction but that he is bidding lower relative to after-repair value due to market activity over the last 90 days.

MACROECONOMIC TRENDS

Rate

Probability

Index

Sentiment Index

HOUSING & MORTGAGE TRENDS

Home Sales

Prices

Mortgage Rate

Mortgage Rate