foreclosure

Online

Learning Resources

In-Person & Online Foreclosure Bidding Process

There are two ways to bid on foreclosure properties in Florida.

Click on each image for a step-by-step guide.

In-Person Auctions

These auctions are live and require bidders to attend in person. They usually take place at the county courthouse.

Learn More

Online Auctions

These auctions take place on county websites. Bidders must pre-register to participate in these auctions.

Learn MoreFAQs

Have a question? Scroll down to find answers to our most Frequently Asked Questions

Start on Auction.com, where you’ll find about 1,100 Florida foreclosures at any given time. Our property pages usually have photos, title information, property reports and financial data to assist you. Once you find a property that you like, click on the link to the county clerk’s website for auction details.

You’ll know because properties that are sold online have a button on the property page that says, “Bid at County Site.” If you don’t see that button, then the property will be sold at an in-person auction, which you will need to attend in person. Please check the county website for the date, time and location of the auction.

Both amounts, when available, will be listed on the property page across from the photos and address. You may want to click on the link that says, “What are these terms?” for a definition of “opening bid” and “estimated debt.”

The credit bid, also called the plaintiff max bid, is usually the minimum amount that a lender will accept for a property at a foreclosure auction. Lenders set this amount because it’s the amount of debt that a borrower owes on a property.

On Florida county websites, this amount is called the plaintiff max bid because the lender is the plaintiff, or party who initiates the lawsuit against the borrower to get reimbursed for its losses. On Auction.com, the amount is referred to as the credit bid.

Buyers can use the credit bid or plaintiff max bid to more easily decide which properties to bid on ahead of time.They can develop a strategy in which they only bid on properties with an amount that meets their criteria. Conversely, they can avoid unnecessary trips to the courthouse or auction venue and save time and money.

It’s important to note that having the credit bid revealed on numerous properties ahead of time is practically unheard of. This is an opportunity that buyers should jump on while it’s available.

In-person auctions are held in the counties listed below.

- Baker County

- Bradford County

- Calhoun County

- Collier County

- Columbia County

- DeSoto County

- Dixie County

- Franklin County

- Gadsden County

- Gilchrist County

- Glades County

- Gulf County

- Hamilton County

- Hardee County

- Hendry County

- Hernando County

- Highlands County

- Jackson County

- Jefferson County

- Lafayette County

- Lake County

- Levy County

- Liberty County

- Madison County

- Monroe County

- Okeechobee County

- Seminole County

- Sumter County

- Suwannee County

- Wakulla County

- Washington County

The next step is to pay the remainder of the bid. Most counties require payment within 24 hours. Check the county website for details on when and how to pay for the property. After you pay, you'll usually receive a Certificate of Sale. If there are no encumbrances on the title, the county should issue a Certificate of Title. Please check with the county for details.

If you don’t pay the balance of your final bid within the time allotted, you’re likely to lose your deposit and the sale will be nullified. You may also incur other fees and charges. This can cost you thousands of dollars. Be sure you want to buy the property before you start bidding on it.

County law dictates how Florida foreclosure auctions are conducted. Some counties offer an online experience, while others require you to attend an in-person auction. The table below lists all of the Florida counties that conduct online auctions.

- Alachua

- Bay

- Brevard

- Broward

- Charlotte

- Citrus

- Clay

- Duval

- Escambia

- Flagler

- Hillsborough

- Indian River

- Lee

- Leon

- Manatee

- Marion

- Martin

- Miami Dade

- Nassau

- Okaloosa

- Orange

- Palm Beach*

- Pasco

- Pinellas

- Polk

- Putnam

- St. Johns

- St. Lucie*

- Santa Rosa

- Sarasota

- Volusia

- Walton

*Palm Beach County and St. Lucie County use a different company to operate their websites so their registration process is slightly different. Please check each county’s website.

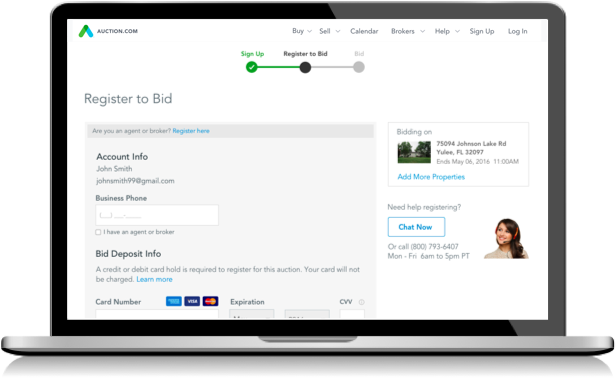

Yes, you can participate in the online county auction. The auction is open to anyone who registers on the county website and has the funds available to purchase a property. If you decide to participate, follow these steps:

- Agree to the disclosures on the county website

- Register for the auction

- Finish your research

- Place your deposit

- Bid on the property

- If you have questions, please refer to the contact information on the county website.

To register, follow the prompts on the county site. It will ask for your name, email address and other identifying information. You’ll also be asked to create a username and password. Be sure to save your credentials so you can log back into the site.

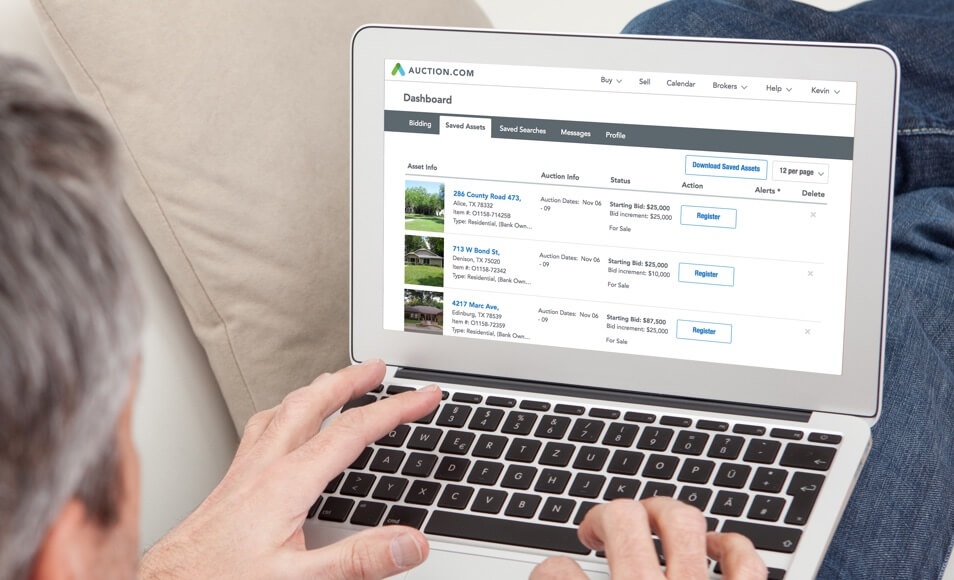

On most county sites, you can go back to Auction.com to do more research by clicking on the green message at the bottom of the property card. Please verify the address and property data to confirm that you’re bidding on the correct property.

The credit bid, also called the plaintiff max bid, is usually the minimum amount that a lender will accept for a property at a foreclosure auction. Lenders set this amount because it’s the amount of debt that a borrower owes on a property.

On Florida county websites, this amount is called the plaintiff max bid because the lender is the plaintiff, or party who initiates the lawsuit against the borrower to get reimbursed for its losses. On Auction.com, the amount is referred to as the credit bid.

Buyers can use the credit bid or plaintiff max bid to more easily decide which properties to bid on ahead of time.They can develop a strategy in which they only bid on properties with an amount that meets their criteria. Conversely, they can avoid unnecessary trips to the courthouse or auction venue and save time and money.

It’s important to note that having the credit bid revealed on numerous properties ahead of time is practically unheard of. This is an opportunity that buyers should jump on while it’s available.

Learn About Your County

Here’s how to get county information:

- Click in the pull-down below to find a county that interests you

- Select a county and you’ll receive the address of that county’s courthouse

- You’ll also have the option of visiting the county website or browsing properties

Loading Properties . . .

Let’s Start Bidding

Browse hundreds of Florida properties, create an account and register to bid.

Create an Account & Enjoy the Benefits

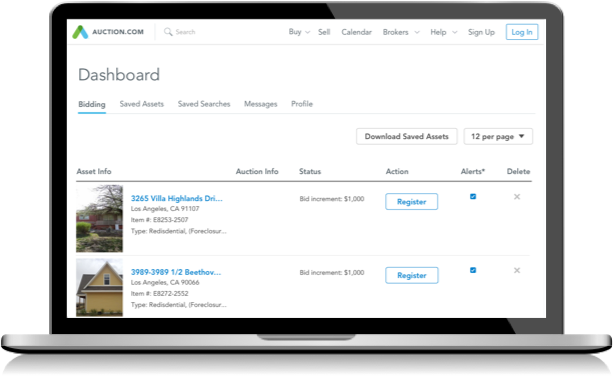

Gain easy access to property reports, title information and your own personal dashboard.