Scroll down to find answers to Have Questions?

We’ve got answers.

Frequently Asked Questions.

Auction.com account basics

Why do I need an account?

You need an account to bid on bank-owned properties, as well as certain foreclosure sales. Even if you don’t need an account to bid, it’s beneficial to have one because it gives you access to a dashboard where you can save properties and receive messages. It also gives you access to important due diligence documents and allows you to receive notifications on the property status.

How do I create an account?

- Click “Sign Up” from the navigation bar on the home page.

- Enter your information in the form.

- Check your email for the confirmation and confirm your new account.

Can I set up a joint account?

No, you need to set up your own account with your own login. This is a security measure so we can keep track of individual buyers.

What if I forgot my password?

- Click the “Log In” tab from the green navigation bar on the home page.

- Click “Forgot Password?”

- Enter your email address and submit.

- Follow the instructions sent to your email.

Can I cancel or deactivate my Auction.com account?

Yes. Call Customer Service at (800) 793-6107 or send an email to customerservice@auction.com and request to deactivate your account. You can always create a new account later.

What is the VIP program?

The VIP program offers exclusive benefits to investors who buy many properties per year.

Do you have an app?

Yes, you can find us in the iTunes App Store or in the Google Play Store. We support iOS and Android.

Why aren’t my apps uploading?

If your apps are no longer updating, then you may have an old app and will need to download a new one. Please find our most recent version in the iTunes App Store or the Google Play Store.

REO Registration Limits

Why am I limited to how many properties I can bid on?

At Auction.com, our goal is to create a fair and thriving marketplace for everyone, and we want to empower our users to be prepared and confident to bid. We recognize that it can be easy to get overwhelmed during the bidding and closing process. Therefore, we have established limits for certain customers to ensure they are set up to be successful, limiting bidding to 3 assets at a time, including any properties that have been won during an auction and are moving through the contract stage.

How can I get approval to bid on more properties?

To unlock an additional registration opportunity, you can create a purchase profile, to help you quickly complete the first step in the closing process if you are successful at winning the bid on a property.

Will I always be restricted in how many properties I can bid on?

No. Once you successfully win a property and close that transaction, your account will be updated to allow you to register for additional properties at the same time.

What happens if I register for a property in error and it affects my limit?

We recommend that you do your due diligence before registering to bid on any properties. It is critical that you select to register for only those assets in which you feel most prepared to buy. If you do find that you registered for a property in error, you can call our Buyer Experience Team at 800-793-6107 and speak with one of our representatives.

REO Match the Bid

What does it mean when I see a property labeled “Match the Bid”?

On properties featuring a “Match the Bid” icon, the winning bidder will have 6 hours to complete their contract information form and move forward in the closing process. During that timeframe, other non-winning bidders can match the winning bid amount and get in line to purchase that property should the winning bidder not complete their obligations in the 6-hour timeframe.

Why do I get only 6 hours to complete my contract information form?

As with any real estate transaction, time is of the essence and Auction.com sets specific milestones to ensure properties that sell in auction move into the closing process as quickly as possible. The completion of the contract information form is the first step in the contracting process, required to generate the purchase and sale agreement.

I’m worried that I might not be able to complete my contract information form within the required timeline. What do I do?

While completion of the contract information form should take less than 15 minutes, you can also get a jump on the process by completing your purchase profile ahead of the auction! If your purchase profile is complete prior to winning the bid, it is as simple as selecting the relevant profile and clicking through to submit those answers to complete your contract information form. If your purchase profile is already created, completing the contract information form should take 5 minutes or less.

I didn’t win the auction, but I still want to buy this property. How do I Match the Bid?

With Match the Bid properties, you still have a chance to potentially win the property! To get in line as a back-up bidder after the auction closes, you must certify that you will match the winning bid amount and upload the relevant purchase profile you would like to use for this purchase, if you become the winner. If you haven’t yet created a purchase profile at the time of matching a bid, you will be given an opportunity to complete one before you are able to successfully submit your Match the Bid request. The first person to complete both steps—agreeing to match the winning bid and selecting the relevant purchase profile to use—will be first in line to win the property, should the original winner not complete their obligations in the required timeframe.

I didn’t bid on the property in this auction, but I’d like to submit a Match the Bid request to be considered. Am I able to do that?

At this time, no, you will not be included in the Match the Bid period. Only those people who registered and bid on the property during the current auction will be invited to participate in the Match the Bid period. We encourage you to always register and bid on any properties you’re interested in, so you don’t lose your chance to purchase!

How do I buy a bank-owned property online?

How do I participate in a bank-owned online auction?

You can browse bank-owned properties by clicking on the “Buy” tab from the green navigation bar. Then, click either “bank-owned homes” or “bank-owned & newly foreclosed homes.” We recommend creating an account before you start browsing, so when you find a property that you like, you can save it to your dashboard and register to bid on it. You cannot register without having an account.

How do I register for a bank-owned online auction?

To register for an online auction, do the following:

- Log in with your email and password.

- Next, find your property and click on the property photo or link for more information.

- Click the “Register to Bid” button.

- Your name and email address will be auto-populated.

- We will confirm your registration details after your registration is complete. Be sure to check your email to confirm the date and time of the auction.

Why can’t I have more than one account associated with my phone number?

We require one unique verified phone number for each account in order to place any bids or offers. This is to ensure the integrity of our auctions and enhance the security of information between Auction.com and the responsible bidder for each purchase. If you require multiple vesting information for each purchase, we have conveniently added the Purchase Profiles tab under the Dashboard which allows you to easily create multiple profiles for each purchase.

Why do you need to verify my phone number?

We ask to verify your phone number one time to protect the integrity of our auctions because we want to make sure that all of our bidders are authentic.

Will you use my phone number for other purposes?

No, we will not. We will never use your number for spam and we will only call if we need to contact you.

What is an auction event?

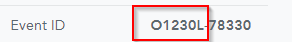

An auction event is a time slot when a group of similar properties are auctioned. To find out if properties are in the same event, compare the Event ID number from the Property Details Page to the Event ID on other properties and see if they are the same. Note: Only the first six digits need to match, the remaining digits are the Item number.

What is Direct Offer?

Direct Offer is a feature that allows you to make offers directly to sellers on select bank-owned properties outside of an auction. Direct Offer properties can be found under the “Buying Type” tab on the Search Results Page.

How do I conduct due diligence on a bank-owned property?

Conducting due diligence involves estimating the value of a property and its renovation costs, investigating the physical property, obtaining a title report, and researching the surrounding neighborhood. Learn more.

What does it mean when the property is listed as a “cash only purchase?”

“Cash only” means that the property has to be paid in full following the auction. The funds that you use to buy the property need to come from your bank accounts, securities or other accounts. Some investors use private money from other sources but wherever it comes from, the funds need to be readily available so you can purchase the property immediately.

What is the Reserve Price?

The Reserve Price is the minimum amount accepted by a seller. Most properties have an established Reserve Price, although there are occasions when a winning bidder can be declared even if the Reserve Price isn’t met. This occurs when a property is sold “subject to” the seller’s approval. Sometimes, sellers sell a property for less than the Reserve Price.

What happens if the Reserve is not met?

If the Reserve is not met, the Seller has several options, including:

- Declining all bids and re-auctioning the property

- Selling the property to the highest bidder. These offers are considered “Subject to Seller Approval.”

Why are the bid increments so large?

Bid increments are set to keep the auction moving efficiently towards an acceptable price. As an auction winds down, bid increments decrease to give bidders flexibility to place more precise bids.

How does counterbidding work?

Counter Bidding is a common practice used by all major auction houses. Auction.com will counter bid on behalf of the seller in order to move the price closer to the Reserve Price, or minimum price that a seller will accept. Learn more.

What happens next if I win the auction?

If you are the highest bidder when an auction ends, you will receive an email that confirms you have the highest bid. Then you must complete some important steps to complete your purchase of the property. Learn more.

What is a Purchase Profile?

A Purchase Profile is an online form that buyers fill out after they win a bank-owned property. It asks how they plan to use the property – such as an investment or primary residence – and a couple of other questions to complete the purchase. You can create as many profiles as you would like but be sure to name them in a way that‘s easy to remember so you can re-use the information for future purchases.

Why does the bid increment change?

As the auction winds down, the increments become smaller to give bidders the flexibility to place more precise bids.

How does Proxy Bidding work?

- Proxy bid is a feature available on bank-owned properties that allows you to place a bid before the auction starts. Once you submit the bid from the PDP, Auction.com will bid on your behalf during the live bidding period.

- You can set proxy bids on multiple properties prior to auctions. When the auctions end, we’ll send an email notification if you are the winner.

Note: all auction bids are confidential.

Do Sellers accept bids below Reserve?

Yes, the Seller may accept a bid below the Reserve. For this reason, we suggest you place your highest and best bid at every auction.

Is the Opening Bid also the Reserve?

The Opening Bid is the amount the bidding will start; it is not the Reserve and may not be what a Seller will accept as an offer.

Why would the auction end time be extended?

Bids placed within the final 2 minutes will extend the auction. This keeps the auction fair by allowing all bidders to place their own last minute bids.

Can I use a mortgage?

Typically, no. Most properties on Auction.com are “Cash only” which means the property has to be paid in full by the closing date.

Can I use financing to buy this property?

Typically, no. Be sure to check the property listing to see if financing is considered. Most properties on Auction.com are sold cash-only. That means you must pay the entire purchase amount by the closing date.

Can I purchase a property with multiple separate entities?

Yes, you can. You can enter up to three entities into your contract and if you would like to be efficient, you can input your entities in advance so that they’ll be pre-populated into your contract the next time you win an auction.

How do I buy a foreclosure for sale?

How do I participate in a foreclosure auction?

On the Auction.com website, you can browse foreclosure properties by clicking on the “Buy” tab from the navigation bar on the top of the page. Then, select “foreclosure sales“ in the dropdown. When you find a foreclosure property that you like, save it to your dashboard and follow these steps:

- Conduct your due diligence investigation.

- Prepare your funds. Properties sold at foreclosure sales often must be paid in full on the day of the auction. Check your state’s requirements.

- Research the venue so you know where and when the auction will be held.

From the mobile app, you may be able to electronically place a bid on select properties before the auction or participate in real-time bidding. All remote bidders must prequalify in advance before placing a bid. To do so, open the Auction.com app and follow these steps:

- Find a property and conduct your due diligence.

- On the property details page or in the Setting Page of the mobile app, click on the “Qualify for a Remote Bid” button

- Fill out the Bidder Profile and the Remote Bid agreements via DocuSign within the app

- Once you have been approved, you will receive an email shortly afterward with instructions on how to fund your escrow account

- In order to bid, your funds will need to be in your account by 2 p.m. (EST) the day before the auction.

Do I need to pay for the property in full at the auction?

Most foreclosure sales must be paid in full with cash or a cashier’s check on the day of the auction. Check your state’s requirements to see if you can pay part of the balance at the auction and the remainder within a certain timeframe, such as 30 days.

Are these properties free of liens?

It depends. Some properties have liens and some states have laws in which the lien doesn’t carry over to the new owner. As part of your due diligence, you should order a complete title report on the property that you wish to purchase.

Why was this property sale postponed or cancelled?

There are many reasons why a foreclosure sale may be postponed or cancelled. When you save a property to your dashboard, you’ll typically receive an email alert if the sale is postponed or cancelled. You can also check the website before leaving for the auction. Sales may be postponed or cancelled for some of the following reasons:

- The homeowner and lender agree to postpone the sale.

- The homeowner may have filed for bankruptcy. When this happens, it usually results in a cancellation and the lender has to start the foreclosure process all over. Bankruptcy does not stop foreclosure, it simply delays it until the homeowner resolves the debt or the lender gets approval from the bankruptcy court to continue the sale.

- The lender may sell the property before the auction.

Can I find out if a sale is postponed or cancelled before I attend the auction?

Yes. While browsing properties, save the ones you like to your dashboard and you’ll typically receive an email alert if that sale is postponed or cancelled. You also may want to check the property status on the property details page before leaving for the auction.

Is there a calendar showing the dates and times of upcoming live auctions?

Yes, there is a calendar. Here’s how to find it:

- Click on the “calendar” tab from the navigation bar on the home page.

- Enter the auction dates, location, type of property and venue.

- You will then receive a list of auctions.

- Visit our Real Estate Auction Calendar to see how it works.

How do I use a real estate agent with Auction.com?

Can I use a real estate agent and how does it work?

Yes. We welcome agent/broker participation with our bank-owned properties. Just follow these steps:

- Check the property details page to see if a commission is offered. Even if one isn’t offered, the agent may be able to earn a commission when you flip or rent the property.

- Have your agent or broker register for the property 24 hours before the auction.

- Identify your broker or agent when you register for the auction.

- Agents and brokers must be licensed in the state where the property is located.

- Agents and brokers must provide a completed Participation Form and IRS Form W-9.

How much commission is offered on your properties?

Commissions vary from property to property on bank-owned properties. Check the property details page for details. By law, commissions are not allowed on foreclosure sales.

As a buyer’s agent, what are some of the benefits of working with Auction.com on bank-owned properties?

Some bank-owned properties offer commission. In addition, many of our properties are exclusive to our platform so when inventories are low, this provides a significant advantage to the agent. Auction.com also facilitates the closing process and our transparent platform allows buyers to compete on a level playing field.

What happens if I win the auction?

What happens after I win a bank-owned property auction?

If you are the highest bidder at the end of an auction, here are your post-auction obligations:

- Contract Information: Your information is required to generate the Purchase Agreement. You will receive an email confirming you have the highest bid. You will then need to provide important contracting information by filling out a form online. To access this form log in to Auction.com and access your Saved Assets. Click on the blue “Submit Contract Information” button to begin the form. You can preview the required information on this form as a printable checklist. Make sure to submit the form within 1 business day.

- Purchase Agreement: Once everything is verified, the Purchase Agreement will be generated and you will need to sign and return the document for the seller to review and sign.

- Proof of Funds: You will need to upload a copy of your Proof of Funds into your dashboard within 1 business day of the auction for approval before we send your contract to the seller.

- Earnest Money Deposit: Unless otherwise specified in your purchase agreement, you will need to send the Earnest Money Deposit to the closing company 1 business day after the auction and upload a copy of your confirmation receipt into your dashboard the same day for approval before we send your contract to the seller.

If the property is being sold as “subject to seller’s confirmation,” the seller must approve your auction bid before the sale can be finalized. During this time, the seller will review your bid and determine if it is within their acceptable range. You will receive an email notification if this applies.

Lastly, you will move into the escrow/closing process and be assigned a closing specialist. Your closing specialist helps ensure a smooth closing process.

Note that specific requirements may vary on a per-auction basis. Please carefully review all communication from our team to ensure everything is submitted correctly and in a timely manner.

What happens after I win a live foreclosure auction?

Typically, this is what happens after you win:

- In most states, you have to pay for the property in full immediately following the sale. Check your state’s requirements. We recommend paying with a cashier’s check.

- In many states, you will receive a Certificate of Sale after you pay for the property. Check your state’s procedures for further details.

- After you purchase the property, you typically have to record the deed with the county. You will be responsible for ensuring that the deed is recorded. This is not part of the Auction.com process. Check your state’s requirements for details.

- Do not attempt to enter the property, even if it’s vacant, until you have the legal right to do so. If the property is occupied, you may want to contact a real estate attorney for assistance.

Can I purchase a property as a separate entity?

Yes, you can purchase the property as a separate entity, such as a Limited Liability Company or a Trust, but you’ll have to provide specific documentation. Read on to learn more.

Will I get a deed after I purchase a property at a live auction?

After you purchase the property, you typically have to record the deed with the county. You will have to do this yourself, as this is not part of the Auction.com process. Check your state’s requirements, as each state may be a bit different.